See if you qualify for a Pledge Asset Line or Securities Backed line of Credit

Learn More

Are you an investor that wants their money always working for them?

Securities Backed Lines of Credit allow you to keep your money invested while loaning off or your managed investment accounts.

Securities-Backed Line of Credit More technically-

A securities-backed line of credit is a borrowing product based on the proven approach of pledging eligible securities as collateral. It offers access to liquidity without disrupting a client’s investment strategies and objectives.

What can these accounts be used for?

Business Expansion, Business investments, Bridge Loan Financing, Real Estate Purchases, Luxury Purchases, Taxes or Other Seasonal Payments, ACAT Transfers and much more!

The Advantages of Pledging Assets

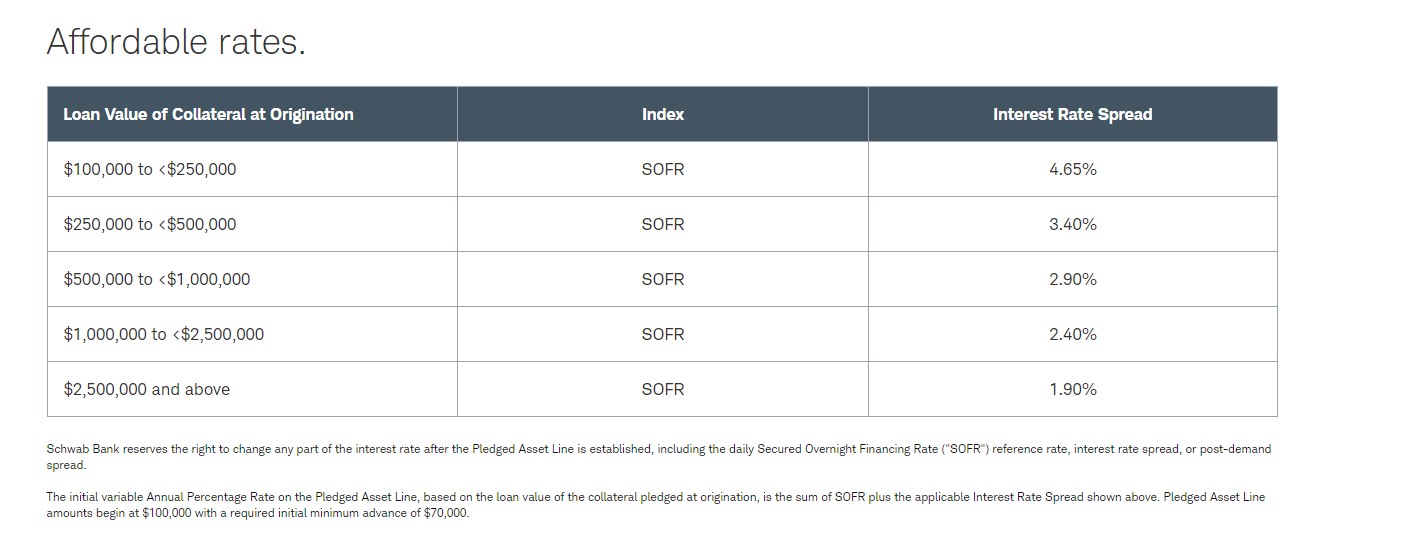

Extremely Competitive Rates – Both LIBOR-based variable rate and fixed rate options

are available.

Speed – Our streamlined process enables us to deliver loan documents

within 5 business days.

Value – Provides access to liquidity without the immediate sale of securities.

Flexibility – Multiple portfolios can be used as collateral. Individuals, entities and

trusts are eligible to borrow and pledge.

ACAT Transfers – Facilitate the transfer of client investment accounts by paying

off existing loans.