Karstens Wealth is an independent financial adviser.

Karstens Wealth provides money management for our clients by incorporating financial planning, investment portfolio management, risk management and other

aggregated financial services.

We combine industry experience and comprehensive research to provide quality advisory services to our clients. Currently, we offer the following investment advisory services,

which are personalized to each individual client:

Financial Planning Services

- Net-worth analysis

- Cash flow planning

- Strategic asset allocation

- Investment Management

- Risk Planning

- Retirement planning

- Traditional IRAs

- Roth IRAs

- Qualified retirement plans

- Company retirement plan rollovers

- Education planning

- Education savings accounts

- 529 college savings plans

- Custodial accounts

- Trust, estate planning and asset titling

- Annuities

- Life Insurance

- Business Insurance

- Liquidity and cash flow strategies

- Tax planning and liability management

- Social Security

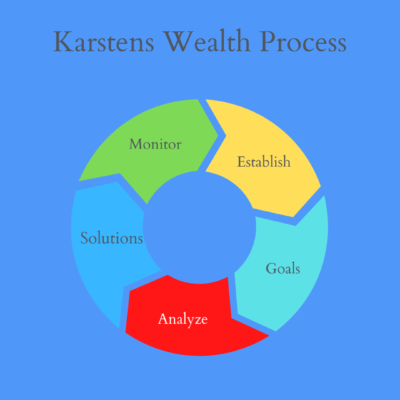

At the outset of any engagement, Karstens Wealth management conducts a review of a client’s financial situation to determine first whether the client needs Karstens Wealth services and, only then, how best to fulfill that need.

Advisory services offered through Karstens Wealth. Karstens Wealth LLC and Karstens Financial LLC are independently operated. Securities offered by Charles Schwab member FINRA/SIPC.